|

Hello Ryder Mortgage Groupies!

As we head into fall thought that I should send a note on what I see ahead regarding mortgage rates and the housing market as we finish up 2023 and head into 2024.

First, lets look back. For those that follow me on LinkedIn, or read my articles at The Scotsman Guide (a Mortgage Industry publication), back in April 2022 – back when mortgage rates were still in the 4’s, I said mortgage rates would reach as high as 7.625% in the summer of 2023. We got there a few weeks back.

I also forecasted that despite rising rates, we’d see a stable housing market. Despite the crazy mortgage rate headlines, the forecast rang true as well. For some odd reason – I was the first to be able to put together those puzzle pieces.

In the Spring of 2022, those two forecasts inadvertently were seen by folks outside of my circle – and well, fast forward to today, it’s you all that I was really providing those for; but I’ve been asked to share my data and methodology to fellow industry nerds. The 'why' behind my foreceasts have now been shared inside of national webinars by more than a few top lenders - so "I think I think" folks are starting to adopt my approach to how we might be thinking about the upcoming two or three quarters.

Here's what I'm looking at:

Last year’s correctly called forecast was based on looking at similar economic trends that surfaced in the late 70’s and early 80’s (more on that in a sec). We had to go that far back to see such an economic boom as the one that we saw post-Covid.

Now, let’s look forward. Even though Federal Reserve Chairman Jerome Powell states that he believes in a soft-landing, the data is (in my opinion) pointing in another direction. The last time our country saw the Federal Funds Rate rise this fast? You guessed it... back to when disco ruled the AM radio dial. To be exact – it was the Spring of 1980 through early 1981. July of 1981 started a recession that lasted 18 months until November of 1982. I think its still prudent to compare where we might be headed to what happened then.

According to FederalReserveHistory.com, what caused that specific recession was “tight monetary policy in an effort to fight mounting inflation". Sound familiar?

If we simply stick to the same “past behavior is the best predictor of future behavior” forecast modeling – I think our country will be in a recession starting in June of 2024.

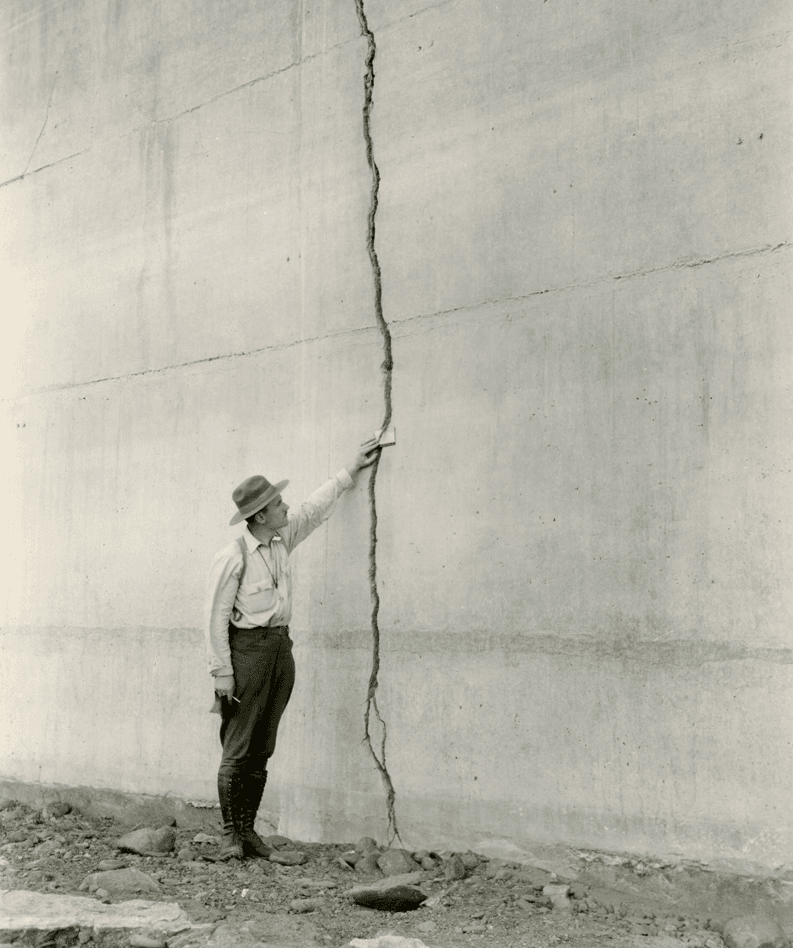

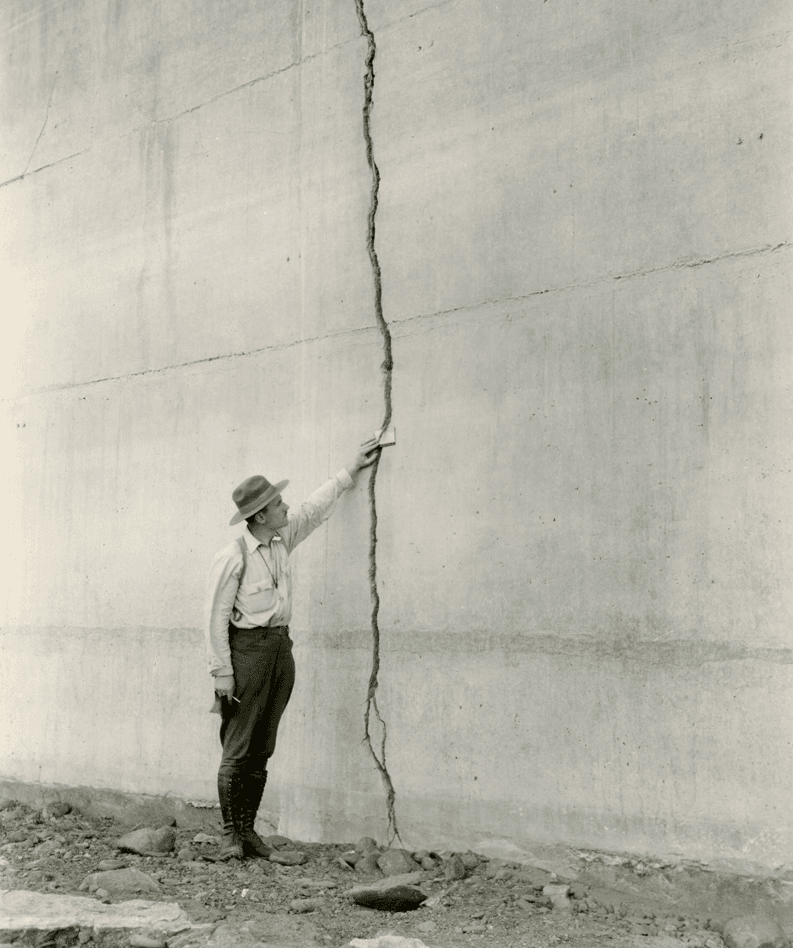

Below are some crack's that we see in Chairman Powell's Soft Landing Dam:

|