Recent Articles

Should You Buy a Home Before Your Divorce is Final? Here’s What to Know

Buying a house before your divorce is finalized? Here’s why it could create legal and financial complications—and how to plan smart.

Published on 07/08/2025

Looking for Something to Calm Your Summer? How About Opting Out?

Did you know the moment you apply for a mortgage, the credit bureaus can legally sell your personal info to dozens of other lenders? It’s called a trigger lead — and it’s why your phone explodes with spam calls within hours. The good news? Congress is this close to shutting it down for good. The bad news? The House and Senate can’t agree on how — and they’re about to fumble the whole thing. In this week’s article, I break down what’s happening, why it matters, and how you can take five minutes to stop the madness (and save your future self a summer full of spam).

Published on 06/26/2025

What AI Said Would Happen to the Housing Market if Rates Suddenly Dropped to 5%

Artificial Intellegence predicts the future of the housing market if rates droppped.

Published on 06/16/2025

Thoughts on the LA Fires and Home Insurance

Fire Insurance, LA Fires, Gauranteed Replaacement Cost

Published on 02/04/2025

2024 Portland, OR Metro Housing Market Year in Review + 2025 Forecast

2024 Portland Metro, OR Housing Market Year in Review

Published on 01/07/2025

A Non-Party Affiliated review of Trump’s Return: A Market and Economic Overview for the Mortgage and Real Estate Industry

Trump’s Return: A Market and Economic Overview for the Mortgage and Real Estate Industry

Published on 11/06/2024

What if Jerome Powell Doesn't Lower the Federal Funds Rate in September?

September 2024 FOMC Meeting

Published on 09/02/2024

5 Reasons Buying a Home Now – Makes Mathematical sense, and yes, yes, I know that Rates are Expected to Come Down!

Mortgage Math

Published on 08/01/2024

Will the Election Affect Mortgage Rates?

Will the Election Affect Mortgage Rates

Published on 06/04/2024

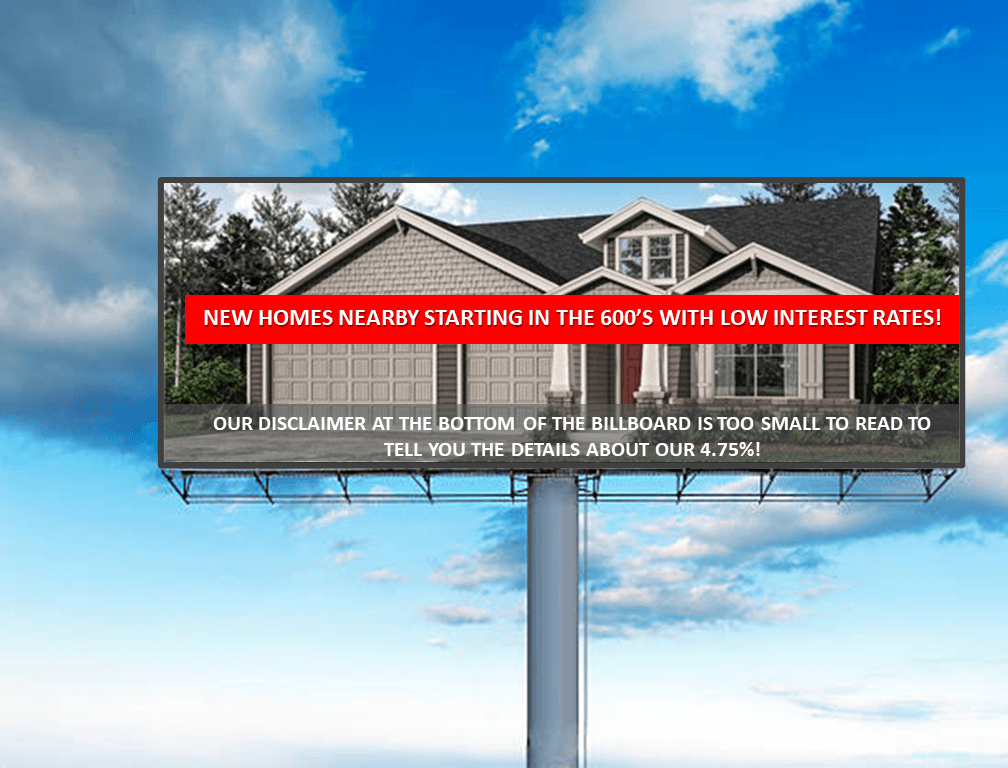

How the Heck do Homebuilders Have Those New Lower Rates?

New Construction Mortgage Rates

Published on 03/01/2024

Why are Mortgage Credit Scores Different Than What I see when I Pull It?

Mortgage Credit Score Calculations

Published on 02/06/2024

2024 CalHFA Dreams for All Down Payment Assistance Program Update

Update on the 2024 CalHFA Dreams for All Down Payment Assistance

Published on 01/22/2024

Where are Mortgage Rates Going? It depends on how "soft" this landing is or isn't.

Recession is coming an the Federal Reserve is not looking at underemployment levels

Published on 01/10/2024