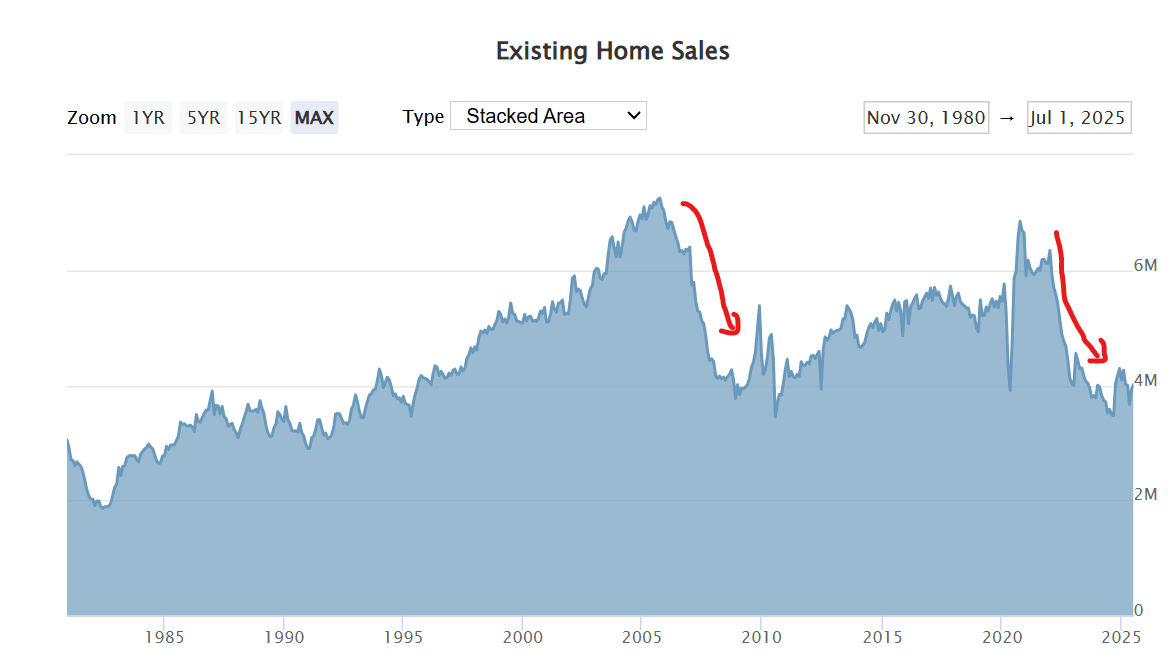

As you can see, the only other time in the last 60 years we’ve seen such a sharp drop in sales was the period following the 2006 peak — when even one-armed, stated-asset, stated-income, no-credit-check professional accordion players were getting mortgages — all the way to the 2008–09 housing collapse.

We all know why that collapse happened: it was a credit crisis. Irresponsible banks were handing out irresponsible loans to people who shouldn’t have had mortgages in the first place.

So why a slowdown now? Affordability. Mortgage rates were artificially low during the Covid crisis. Buyers who normally wouldn’t have been able to purchase until years later jumped in early because their monthly payment was at or below what they were paying in rent. In effect, the pandemic pulled forward demand that we would have otherwise seen between 2023–2025. With that surge, demand outpaced supply and drove up prices.

Will sales volume pick back up? If you look back to around 2010 and compare it to where we are today, the chart suggests we could see recovery by 2026.

Here’s why: in my last article I explained (I won’t rehash it all here) that even with a few expected Federal Funds rate cuts, I don’t expect mortgage rates to drop much in the next 6–9 months.

The only thing that can spark a real surge in sales volume is lower monthly payments. If rates aren’t coming down significantly, the other variable in the equation is price.

And we’re already seeing it around the country — even more so here in Portland. Homes are sitting longer. Buyers are regaining leverage in negotiations. Sellers are getting anxious. And unemployment is starting to creep into the conversation. A few months back, I forecasted that by summer 2026, conditions could line up for home prices to drop about 10% nationally compared to summer 2025. Even if mortgage rates don’t fall, that makes homes 10% more affordable simply due to price correction.

If homes become more affordable, sales volume will increase, and the affordability cycle begins again.

So, if history rhymes, we’re not setting up for another collapse — but rather for the first signs of a thaw in 2026.